Table of Contents

Types of ownership in a business – Premise!

Starting a business is one thing, and making it a success is quite another. If you are familiar with accounting, you can recall one of the fundamental lessons of accountancy that any business is a “going concern” means companies are long-term projects. You start them with the belief that they live last perpetually. And when something is as valuable and long-term as a business, you must pay due diligence and attention to its structural framework.

Why choosing the right type of ownership in a business is critical?

Choosing the suitable ownership model for your business from several available options is the first and most important task in setting up an enterprise. An entrepreneur cannot afford to pick the wrong type of ownership in a business as it will mess up the foundation of an enterprise and compromise its growth prospects.

Entrepreneurs’ capital, time, and other resources are invested in a business idea, and they don’t want it to go down the drain by choosing inappropriate types of business structure.

The requirement of picking the most suitable business structure is almost universal. It applies to traditional conventional businesses and in equal measure to new-age digital enterprises, such as setting up a business around affiliate marketing, where you only facilitate sales for other companies and profit from it. Before moving to meat of the topic, Let me quickly answer few basic questions around businesses

What exactly is business?

A business is combining people and their resources in a structured and organized manner to fulfill the demand for a product or service in the market while making a profit from the same.

Can I run a business without registering?

One can start and operate a Sole Proprietorship firm without registration in most states, but beyond this, options are limited. For more complex and scalable ownership models, registration is a must.

What is an LC company?

LC is an abbreviation for a Limited Company. It’s an ownership structure where owners’ wealth and assets are shielded from the company’s debt.

In this article, we will be exploring all of the different forms of business ownership, from the one that is the most common in today’s world to the lesser-used ones. We will cover what each type means and whether or not there are any restrictions to choosing a type of ownership for your business.

Main Types of Ownership in a business

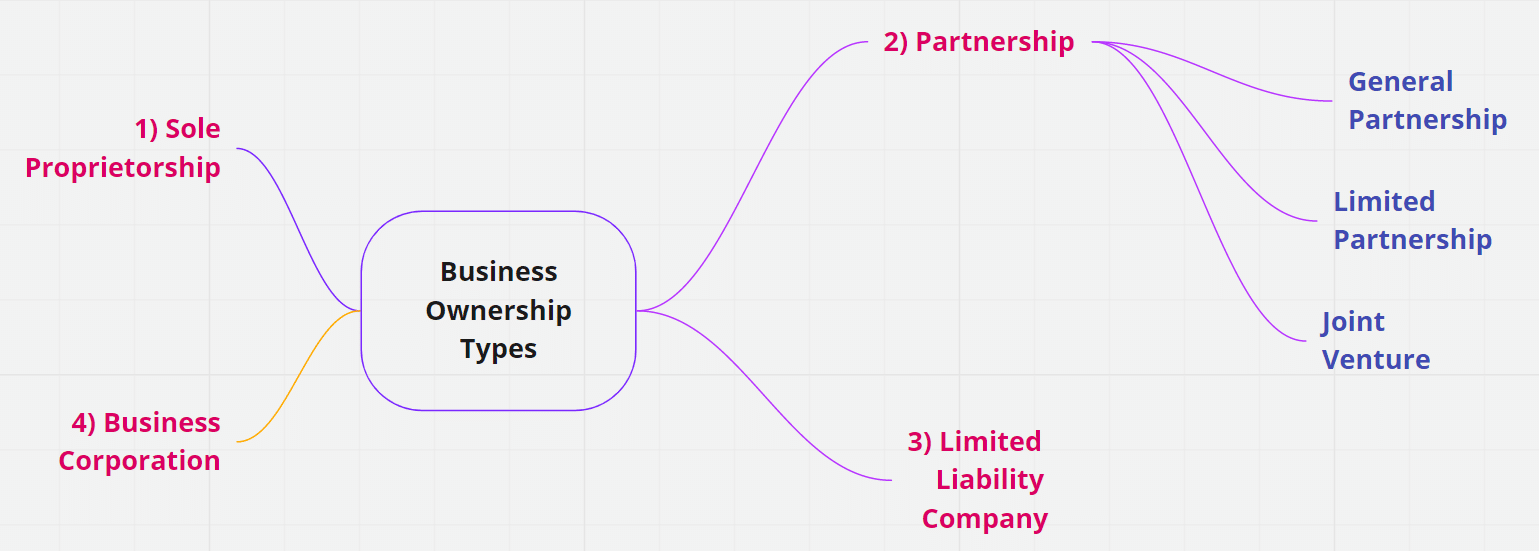

There can be many kinds of business entities in the United States, but the following four are the most important:

- Sole proprietorship

- Partnership

- Limited Liability Company

- Business Corporation

Below is a diagrammatical representation of different types of ownership in a business:

Sole Proprietorship:

Sole proprietorships are the most basic and simplest form of business. It’s an enterprise owned and controlled by one individual. That individual is responsible for all the business decisions, profits and losses, and assets and liabilities. This form of business ownership is inexpensive and straightforward to create and even easier to dissolve if required. Taxation is not tricky or confusing either; as a sole owner, you pretty much don’t pay anything extra above your individual income tax.

There are not many formalities beyond basic bookkeeping. But the biggest drawback is that all liabilities are on the solopreneur alone. Since there is no limitation of the losses your firm may accrue, therefore you don’t have any liability control mechanism in this business model.

Another common downside of this type of business is no enforceable contracts. It can be challenging to hire new employees because there are no written agreements concerning employee perks or wages. There’s also little money to pay employees as these businesses usually have financing issues and funding constraints. Financial crunch often magnifies once a small company looks for expansion.

Sole Proprietors are independent solopreneurs and are not answerable to any management or team. How cool that sounds but wait, if something happens to you or your health deteriorates, there is no one to take control of the ship as there is no team you have nurtured. Despite limitations, this type of ownership has its place, especially for small businesses heavily dependent on an individual’s skill and business acumen.

Partnerships:

Partnership is an association of two or more persons or legal entities (including people, corporations, other partnerships, trusts, limited liability companies, etc.) to start and run a legal business to make profits. These individuals or entities are responsible for the business decisions and all liability and share any gain or loss from business activities.

A partnership can be flexible in terms of structure and administration. It ceases to exist in case of certain conditions, such as bankruptcy or the death of a partner. A partnership can also be dissolved with the consensus of all partners.

Advantages and disadvantages of partnership:

There are several advantages and disadvantages of the partnership model of ownership in a business. Below I am highlighting some of the crucial ones:

Partners pool funds and lay collectively agreed conditions through a legally binding agreement that is enforceable in a court of law in case of a dispute. The partners know the status of assets and liabilities beforehand. Since the liabilities are joint, in case of extensive debt, any partner can be made to pay the entire debt arising out of partnership business irrespective of their capital contribution and share in profit or losses.

Another prime requirement with the partnership enterprise is that business owners report both the profits and losses to the taxation authorities in their state. Thus the bookkeeping must be meticulous and detailed for the partnership ownership model.

There are three primary partnership models let’s discuss them one by one:

General partnership:

General partnerships are a business arrangement by which two or more individuals agree to share all assets, profits, and legal liability. With unlimited liability built into the very nature of the general partnership, any partner could be held responsible for the company’s debts.

Every partner is responsible for their income taxes, including any income from the partnership. If and when a general partnership business scales and starts making significant profits, then inefficiency of this taxation results in relatively higher taxes on the partner’s income.

Despite its enormous shortcomings, general partnerships are still widespread due to their ease and cost-effective formation. Since rules are flexible, it suits family enterprises or closely related people who enjoy each other’s trust. Furthermore, decision-making is much faster and easier to implement when compared with an arrangement like a corporation.

Limited Partnership (LP):

A limited partnership (LP) should not be confused with a limited liability partnership (LLP). A limited partnership must have at least two partners like any other partnership arrangement.

However, one must be a general partner in the LP of two people and another limited partner. General partners have unlimited liability and complete control of the business. If a company gets indebted, then if needed, the general partner must pay beyond their investment in the venture.

Limited partners have little involvement in management to the extent that they can be considered passive partners. Their risk is in proportion to the investment amount into the LP. For limited partners, lesser control comes with the perk of lower risk as their liabilities are limited.

This arrangement often suits small family-oriented businesses where one spouse is a relatively passive partner and the other the leading player in the day-to-day operations.

Joint venture:

A joint venture is a contractual business arrangement between two or more partners, coming together for a specific project or a time-based assignment. Foreign partners typically do it with local ones to enter a domestic market or when one partner funds or provides expertise and other leverages know-how of the local market for a specific joint project.

The parties to the joint venture are known as co-venturers and are bound by a well-drafted legal agreement specifying deliverables and time, scale and location of operations.

Tax treatment of joint ventures varies with the nature, location, co-venturers, and jurisdiction of the projects. The joint venture usually ends with the project. However, if it succeeds, partners often come together for similar projects again or even take their partnership to a more formal and long-lasting business structure like LP or LLP.

Joint ventures have their place in the business world. It allows businesses to test different markets and explore additional opportunities while minimizing their risk by incorporating local partners.

Joint Ventures are an excellent tool for government collaboration with private players to address the typical inefficiencies of government departments and bring the technology, experience, and professionalism of corporate management in a variety of public projects. This concept is popularly known as public-private partnerships(PPP), and it is pretty standard in many parts of the world.

Limited Liability Partnership (LLP)

Limited liability partnerships (LLPs) allow the partnership structure of two or more partners where their respective liabilities are limited to the extent of their investment in the venture. It’s an excellent structure to spread risk and leverage individual talent and expertise to the optimum.

Division of labor in LLP often results in better management and accountability of the partners, hence making business more productive and profitable.

Despite ticking all checkboxes, the risk of failure is inherent in every business. This universal truth makes LLP’s even more attractive ownership structure as assets and income of all partners are legally shielded from creditors in case of failure of an enterprise.

The law considers LLP a separate legal entity, positively affecting tax treatment. This legal standing also allows LLP to scale operations seamlessly. It can buy, rent or lease property, hire staff and enter into legal contracts much like an individual entity.

Another exciting benefit of a Limited liability partnership is that it allows corporate ownership where even companies can join an LLP as partners.

LLP is a great ownership option; however, it is not immune to negatives. One major disadvantage of LLP is that public disclosure is mandatory and financial data of an LLP is submitted to the company’s house for public records, thus compromising members’ financial privacy.

Business corporations:

Business corporations are a unique collective ownership model where members of a community build organizations intending to forward community interest. It is a people-centric business ownership model where the community members and business operations pool capital, labor, and other resources are democratically run with the active participation of cooperative members.

Each cooperative member is a shareholder and has equal voting rights irrespective of their financial or human contribution to the cooperative. However, for administrative purposes, shareholders elect the qualified board of directors to decide on their behalf and run business operations.

Cooperatives are only possible where communities are bound by a robust value system that includes solidarity, self-help, equity, equality, and belief in a common cause of a community. It’s like an extended joint family operating in synch with each other to support and uplift every member. It is essentially democracy in a business where an organization’s aim is the welfare of every member rather than the money-making of a few selected owners.

Despite their socialist and cohesive nature, business corporations are legal entities registered with government authorities. Like any other business structure, they can hire administrative staff, buy or lease properties, have creditors, suppliers and distributors. They interact and do business with the world and pay their share of taxes on profits. However, on the downside, like any other democratic setup, decision-making sometimes suffers, and the consensus is hard to build, leading to missed opportunities in competitive markets.

Public Sector Enterprise

Besides the above-discussed business ownership models, Public sector enterprise is worth mentioning in this ownership guide. It’s a state-owned enterprise, a “socialist” model for enterprises working in a market economy. The operation is similar to a private enterprise, with a few exceptions.

The primary goal of public sector enterprise is to serve the public with a financially sustainable government-owned setup.

Public sector enterprises are also considered a tool by various governments to control the economy. These organizations are usually mammoth in size and scale and are often marred by inefficiencies and bureaucratic red tapes. It is a “closed system,” with no market entry or exit.

The ruling executive appoints managers of state-owned enterprises and usually consists of a mix of bureaucrats and political appointees, not necessarily the most competent and skilled professionals.

Registration benefits all business structures

Now that you know about all significant business structures, you are in a much better position to start your venture. The subsequent vital issue to consider is registering your business to give it a sense of validity and credibility.

Irrespective of the ownership model you choose for your business, it is essential to register it with relevant authorities as soon as possible. The proper registration will lend credibility to your business venture and allow you to sign legally valid contracts, which could help to scale business operations and acquire newer contracts or clients.

Business registration will help market your business and create a brand identity for your enterprise. It will also deal with possible legal issues arising from business transactions. Furthermore, registered ownerships handle taxation-related problems better, profit from due rebates, and take advantage of special exemptions wherever available.

Conclusion – Types of ownership in a business!

Now that a budding entrepreneur, hidden in every reader of this article, knows about different types of ownership in a business and their merits and demerits, it will be easier for them to choose the most suitable business model for their dream project. Remember that one can start with the most basic ownership structure, like a sole proprietorship or general partnership, and scale up to a more complex but beneficial system later for lasting success. As you are clear with the types of ownership structure, you can check another in-depth article on the subject that talks about seven considerations before choosing the appropriate ownership structure for your business

WorthyMBA wishes you a great startup and a wonderful entrepreneurial journey ahead!

Kartikay Ungrish is the Founder-director of Worthy Education Academy & Worthy Financial Services. He is a UGC NET-qualified Assistant Professor of Management, A MBA, a licenced mutual fund distributor, and a financial advisor. He helps people build wealth through prudent investments in mutual funds and other financial products. Start by creating your free wealth management account with him as your financial advisor. Contact for more details.